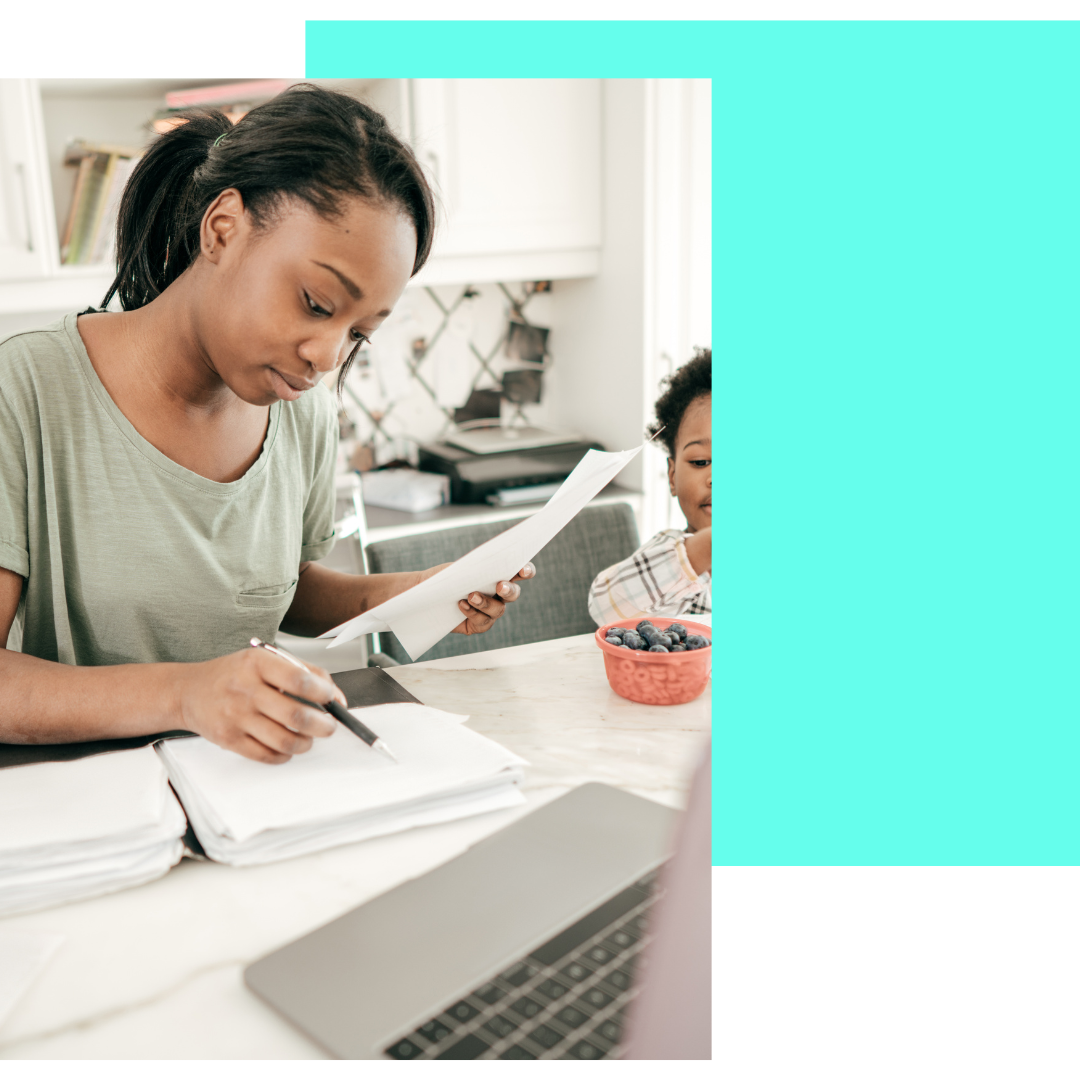

In the first quarter of the year, Australia’s real household disposable income recorded a 4% decrease on a year-on-year basis, a result of ongoing high inflation, elevated tax payments, greater net interest payments, and a drop in small business income, particularly within the farming sector.

This decline was partially offset by strong growth in labor income. Simultaneously, real household net wealth reduced by 8%, largely driven by falling housing prices. Household consumption growth notably slackened since mid-2022, chiefly due to reduced spending on discretionary items, although new car sales held firm owing to previous supply chain issues causing a backlog of orders.

Internationally, spending by Australian tourists abroad increased, though it hasn’t yet reached pre-pandemic levels, while the arrival of international students has buoyed economic activity. Even with slowing growth, per capita household consumption was approaching its pre-pandemic trend, excluding international travel expenses. The housing market demonstrated fluctuations, with recent months witnessing a price recovery following an 8% reduction since April 2022, a situation influenced by robust demand and scarce supply. Rental markets have tightened, leading to significant rental price growth in capital cities, with more moderate growth in regional areas.

Investment in dwellings declined, hindered by supply constraints and a shortage of tradespeople, thereby affecting construction projects. Conversely, business investment flourished over the past year, spurred by machinery and equipment purchases and non-residential construction, although medium-term prospects have dimmed due to factors like labor shortages and waning business confidence.

In the March quarter, growth in public demand decelerated as spending on COVID-19 related health measures diminished. Nevertheless, public consumption remains elevated compared to pre-pandemic levels, supported by initiatives such as the National Disability Insurance Scheme and aged care programs. A robust pipeline of infrastructure projects is predicted to enhance public investment in the future.

The 2023/24 Australian Government Budget, along with state budgets, discloses an improved consolidated underlying cash balance for 2022/23, and smaller anticipated deficits in the coming years, credited to soaring commodity prices and a healthy labor market.

The nation’s GDP in March was mildly impacted by net trade, as robust growth in goods imports outpaced services exports. While rural exports flourished, coal exports faced challenges due to maintenance disruptions. The situation improved in the June quarter, with thermal coal exports to China regaining pre-pandemic levels.

One notable highlight in the export sector has been the surge in Australia’s lithium exports, fuelled by the escalating demand for batteries. This has positioned lithium as the country’s fourth-largest mineral export, trailing coal, iron ore, and gold. The rise in export values is ascribed to both inflated prices and augmented volumes stemming from new mining operations.